GAAP & Auditer PAC : Solution To Managing Agent’s Cost Dilemma

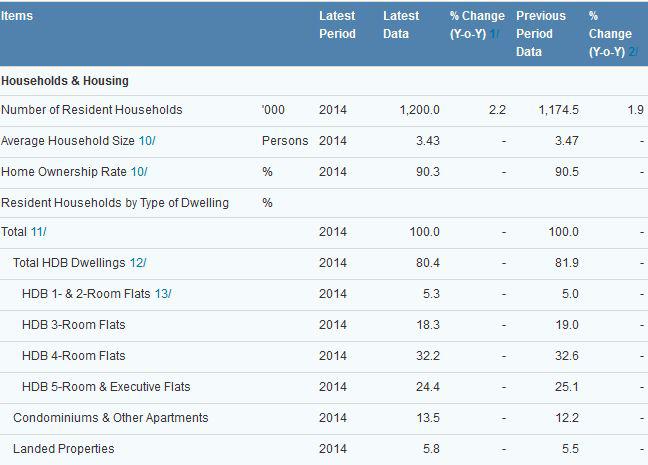

Singapore has one of the highest proportion home ownership in the world at 90.3% in 2014. This is extracted from Singapore’s Department of Statistics or Singstat as it is commonly known. As you can see from the Singstat table below, only 13.5% of residents are staying in condominiums (condo).

Hence in Singapore, the fact that you are staying in a condo carries certain amount of status.

Source:Singstat

Living in condominiums also confers certain privileges over HDB flats with better designs and facilities. The standard facilities that you can expect from buying a condominium would include tennis courts, swimming pools, security guards and gymnasium.

Source:newlaunch-condo.sg

The photo above shows the typical condo facilities in Singapore. They are glamorous, prestigious and highly desirable. So they attract the successful professionals and well heeled families into their fold. Of course, this would come with a higher price tag than HDB flats.

Maintaining The GlamourWhile the glamour is attractive, these glamorous facilities would require a lot of maintenance. For HDB dwellers, the town council would settle the maintenance work for a modest fee. However for condo dwellers, they would have to first form their own ‘town council’ or the Management Corporation in accordance to Building Maintenance and Strata Management Act (BMSMA). We would refer to BMSMA as the law.

The Management Corporation (MC) is automatically formed when the strata title plan for development is lodged with the Chief Surveyor and a strata title application is made to the Registrar of Titles at Singapore Land Authority. Hence the Management Corporation is also commonly known as Management Corporation Strata Title (MCST).

The MCST is formed to maintain the estate such that they stay glamorous as seen in the photo above. In order to do so, the MCST would typically hire a Managing Agent (MA). The MA would engage people to clean the pool, prune the trees and so on. However the most important issue would be to ensure that money paid is being properly accounted for.

Proper Accounting Of Funds

The MCST may choose to handle the account on their own or they can choose to pass it over the MA for an additional fee. The MCST would include the Chairman, Secretary and Treasurer as required by law.If the MCST choose to do their accounts in house, the Treasurer would be responsible for all the receipts and accounts for the condo. The Treasurer would also be obliged to prepare financial certificates under the law and keep all accounting records and prepare financial statements.

As you can see the obligations are very onerous and the MCST would typically pass on the duty to the MA. The treasurer is also a tenant of the unit with a day job. According to the law,

The MA,in exercising the delegated duty of MC,can be held liable for any contravention of the Building Maintenance and Strata Management Act as if committed by the MC [Section 67]. An MA also cannot canvas for proxy vote relating to any election of members of council [Section 68]. Source: Building Construction Authority (BCA)

The MA must ensure that all the accounts are kept properly and they are responsible for any lapse. When money is involved, any lapse would immediately be a sensitive issue. Any hint of misconduct would be heavily investigated. A good example would be the recent saga surrounding the Aljunied-Hougang-Punggol East Town Council (AHPETC). The AHPETC issue came to the surface when the Finance Minister ordered the Auditor General Office to conduct an independent financial audit. The report was released recently on 09 February 2015 and it caught the attention of the general public.

What did the Auditor General's report say?

The report found five key lapses in AHPTEC's accounts:

1.Lack of governance with the transactions with related parties;

2.Poor monitoring of S&CC arrears;

3.Poor record and accounting system;

4.Non-compliance with rules on sinking fund;

5.Insufficient internal records;

Source: Yahoo Singapore

The Yahoo source above would give you the fuller understanding of the issues involved. It turned out to be a long running legal case that has yet to be settled today after several months. The AHPETC saga made it clear that weak accounting and auditing practices can be negative for MAs.

MA’s Cost Dilemma

While the condo dwellers may be well off, they would also like to spend as little money as possible to maintain their facilities. A comparison between HDB and condo

conservancy charges would be instructive.

Source: Yahoo News

Here is rough guide for average condo maintenance fees per month.

Mass market condos with more than 200 units:$200 to $300

Mid-tier condos with fairly large grounds:$500 to $700

Luxury-end condos :Around $1000 or more

Source: stproperties.sg

As you can see from the rates above, the most expensive HDB is just $88 per month while luxury condos would start from $1000 per month for conservancy charges.

Even a mass market condo would cost at least $200 per month in conservancy charges.

We have to remember that these fees would have to cover the cost of maintaining the facilities in addition to the accounting fees. All MAs are aware that they have to

pay their accountants appropriately to hire the talents needed to prevent any lapses. Condo dwellers are aware that they are paying much higher fees than the HDB counterparts.

Hence they are unlikely to pay you more so that MAs can hire better accountants. Furthermore the MA market is competitive and as a business you would not be able to

raise cost too much to pay your accountants without losing the clients. This is the cost dilemma that is faced by a MA.

Solution - GAAP Accounting & Auditer PAC

The solution for you would be to outsource your accounting work. GAAP MCST Accounting Company would handle your accounts at 40% lower than your current accounting costs.

After the accounting is done, Auditer PAC company would also provide auditing service to your company. For more information on how they can help your company save cost,

please contact: Doris Yap. (Doris has more than 15 years of experience dealing with MCST and MAs).

She can be reached at her mobile 9232 7338 or doris.sg@gaapy.com

Type of Property

Current rate

Rate from 1 April '14

Rate from 1 April '15

1-room flat

$18.50

$19.50

$19.50

2-room flat

$26.00

$28.00

$28.00

3-room flat

$37.50

$39.50

$42.00

4-room flat

$49.50

$51.50

$55.00

5-room flat

$61.50

$65.00

$69.00

Exclusive flat

$77.50

$82.50

$88.00

GAAP MCST would handle the entire spectrum of accounting and provide you with the relevant software to track our progress and conduct queries.

©2015 Gaapy.com . Design by VBIS INDIA Pvt Ltd.